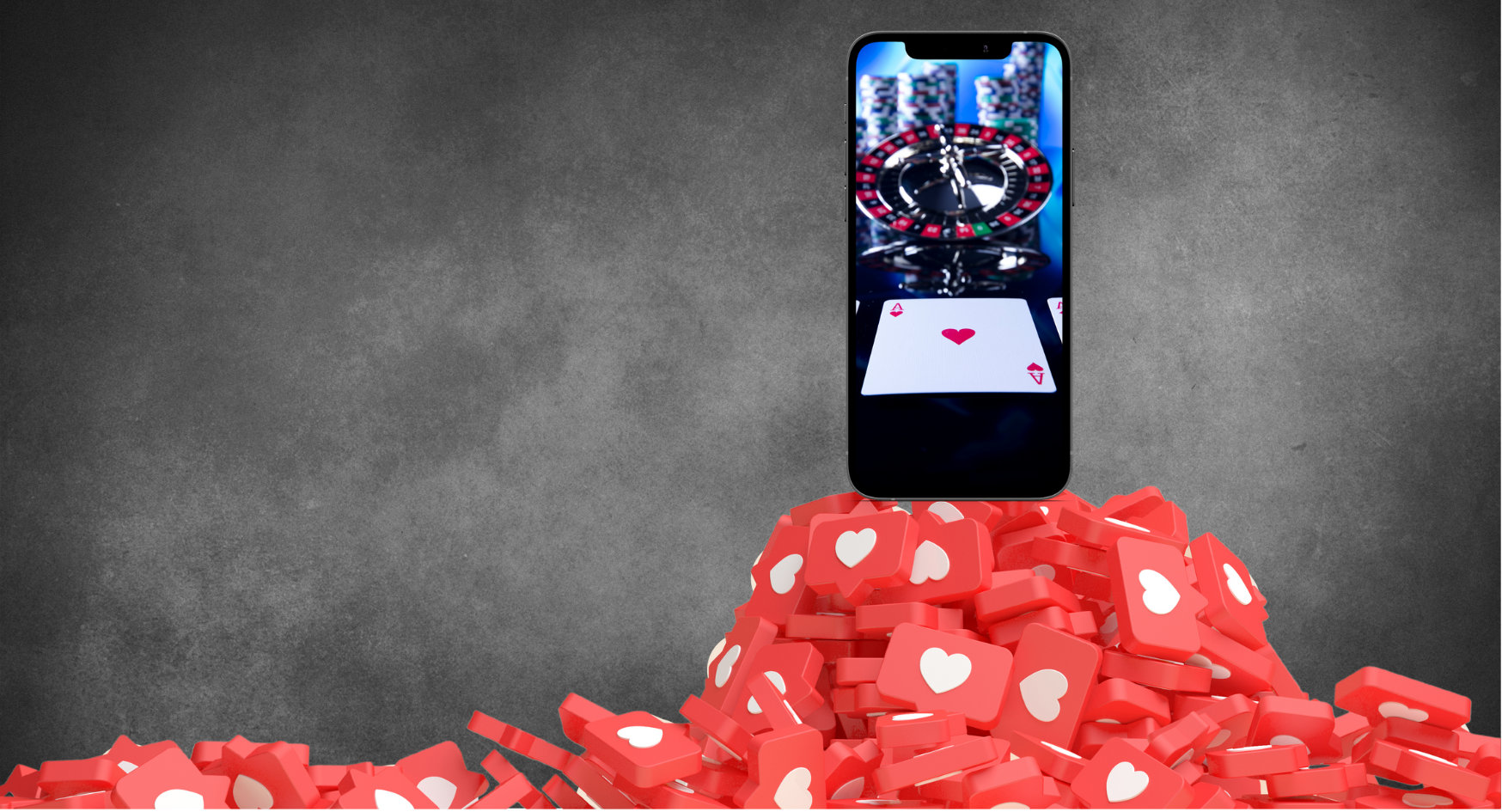

Traditional social media has a plethora of adverse effects. Many of these drawbacks we have heard continually about (and many have been written about on this blog): worsening mental health, increased loneliness, body image issues, etc. But social media, it turns out, can not only affect our mental health, but our financial well-being too.

Comparison & Consumption

Although social media helps us stay connected with friends and family, it also creates an environment based on comparison and consumption. The images and content we see on social media are the highlights from other people’s lives. Constantly seeing other’s best lives can be draining; it can lead to unfair juxtaposition between the highly curated best-of photos of those we follow and our unfiltered everyday reality. Social media can make users feel poorly about their accomplishments or looks—and it can make us feel poorly about our personal finances.

We may wish we had the money to go on that vacation that our friend went on, or we wish we had enough to buy that designer purse our family member posted about. In fact, the socioeconomic class or financial comparisons we make on social media is pervasive and can lead to feelings of jealousy, inadequacy, anxiety, shame and anger. One survey found that social media makes half of Gen Z and Millennial users feel negatively about their financial situation.

These feelings of inadequacy or jealously fueled by the normalization of consumption can drive social media users to spend more and save less. Pictures of vacation photos, outfits and accessories, and new purchases abound. The results from an Australian survey found that over 80% of respondents share material purchases or experiences on social media. In the US, research has shown that more than a third of Americans admitted that their spending is influenced by their social media feeds. In fact, regularly using social media could cause you to overspend and put your financial goals at risk.

Advertisements

Beyond the content we see from creators, social media can lead to increased spending through advertising. These can be especially effective because social media platforms use targeted ads. This is where advertisers take information about us—our search history and online activity, as well as our demographic information like age and ethnicity to created—to market products directly to you. As we continue to scroll, the advertisers gather more information about our likes and dislikes and create even more targeted ads on our feeds. And this type of advertising is hugely successful: one study found that more than a third of Instagram users have bought goods directly from ads.

Marketing strategies often feed on our insecurities. Many advertisements promise happiness, more friends, or better overall well-being only if you buy their product. Companies might also promise weight-loss, better skin, or other beauty-related results. This kind of fear-based spending only leads to more spending and worse emotional health.

Fighting Back

As outlined above, social media can lead to more impulse buying and more stress about our personal finances. Social media also zaps our recharging time, which creates lower attention, drive, and creativity.

Put your phone down

We can take manage of our lives and finances first and foremost by taking breaks from our phones. Regular social media and technological “fasts” can help reorient us and focus on the present. Try to find other ways to unwind or decompress. Those will be more rewarding for you and help you be more focused and a better worker.

Be a critical consumer

It’s extremely important to have a critical eye while on social media. Who posted this and why? How does it make me feel? Who gains from these feelings of inadequacy? By thinking and addressing these types of questions, we can take away the power that social media and advertisers have over us and helps us be in more control of our finances.

Don’t fall for FOMO

One of the major pitfalls of social media is the perpetration of FOMO—or Fear of Missing Out. When we see people online who seem to be living a lifestyle we want, we can be jealous and experience FOMO. But try to keep in mind that most people cannot afford extravagant vacations and outfits. Additionally, we don’t always know the full story behind someone’s curated online presence—or what their financial situation is. One social influencer confessed that she ended up in US$10,000 debt trying to keep up her online persona. It is not worth going into debt to make your online profiles more appealing or exciting.